Quarterly Review - Q1 2025

7th April 2025

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

Macro

2025 kicked off in volatile fashion as global market movements were dominated by the scatter gun approach of the incoming Trump administration. Markets had been sensitive to the remarks of the returning President long before inauguration day, however economists were split – was tough talk on global trade policy, geopolitics and a desire to make Canada the 51st state genuine, or a bargaining chip designed to extract concessions from trading partners? While uncertainty lingers, the first two and a half months of ‘Trump 2.0’ point to a fundamental reset of the global geopolitical order.

Tariffs have been a regular fixture of newspaper headlines since the November election. As I write this review, we are just hours away from Trump’s ‘Liberation Day’ announcement, when the President is expected to set out a series of wide ranging reciprocal tariffs – close allies of the US (including the UK) are not expecting to be spared. Various tariffs are already in effect, including 25% on imports of steel and aluminium, as well as an additional 20% blanket tariff on all goods from China, adding to the 10% that went into place during Trump’s first term. By the time this article goes to print, these may have changed again, so quickly is the tariff backdrop evolving.

Elevated uncertainty has flipped the recent market dynamic on its head. Regular readers will recall the consistency of US equity market outperformance throughout the previous two years. This trend looked set to continue following the outcome of the election, with US equities (most notably small and mid-cap stocks) enjoying another spell of outperformance. With Trump’s Republican Party controlling both chambers, investors felt the administration was well positioned to amplify the US exceptionalism that has driven such extraordinary returns in recent years. But while the prospect of deregulation and the renewal of tax cuts are generally perceived as tailwinds for US businesses, by late February the highly uncertain trade outlook began to weigh on equity markets. Friction in global trade is widely expected to be a drag on growth, and with modelled GDP estimates from the Atlanta Federal Reserve pointing to a sharp downturn in economic activity, fears of a US-led recession rapidly emerged.

In a quarter dominated by US trade policy, there were also noteworthy events closer to home. In the UK, a deterioration in the fiscal outlook forced Chancellor Rachel Reeves to announce £8.4 billion in spending cuts in order to comply with her own fiscal rules. In Europe, the opposite was happening. The recent souring of EU/US relations, coupled with the ongoing war on its doorstep, prompted European Commission President Ursula von der Leyen to propose an additional €800bn spending to boost the EU’s defence capabilities. Similarly in Germany, Chancellor-in-waiting Friedrich Merz proposed to lift the country’s ‘debt brake’, designed to limit government borrowing, to invest in defence and infrastructure.

Despite growth concerns dominating headlines later in the quarter, inflation remained stubbornly above target in both the US and UK, with tariffs adding a further layer of complexity for central bank policymakers to navigate. With the US economy seemingly at a juncture, the Federal Reserve (the Fed) opted to hold interest rates steady, while leaving the door open to cuts later in the year. The Bank of England cut its headline rate by 0.25% in February but struck a cautious tone with respect to future cuts, while the more benign inflationary backdrop in Europe prompted two additional 0.25% cuts by the European Central Bank.

Markets

In a mixed quarter for global markets, US equities were the worst performing major region. Large caps gave up more than 7%. Small caps, which had enjoyed a run of remarkable performance in the build up to, and immediately after, the election result, fell more than 12% on average. For UK investors exposed to currency risk, dollar weakening was a further headwind. All the Magnificent Seven posted losses, with only Meta (Facebook) avoiding a double-digit fall. Elon Musk’s Tesla was the worst performer, slipping to a quarterly loss of nearly 38%, as investors questioned his ability to juggle increasing political involvement with management of the world’s ninth largest company.

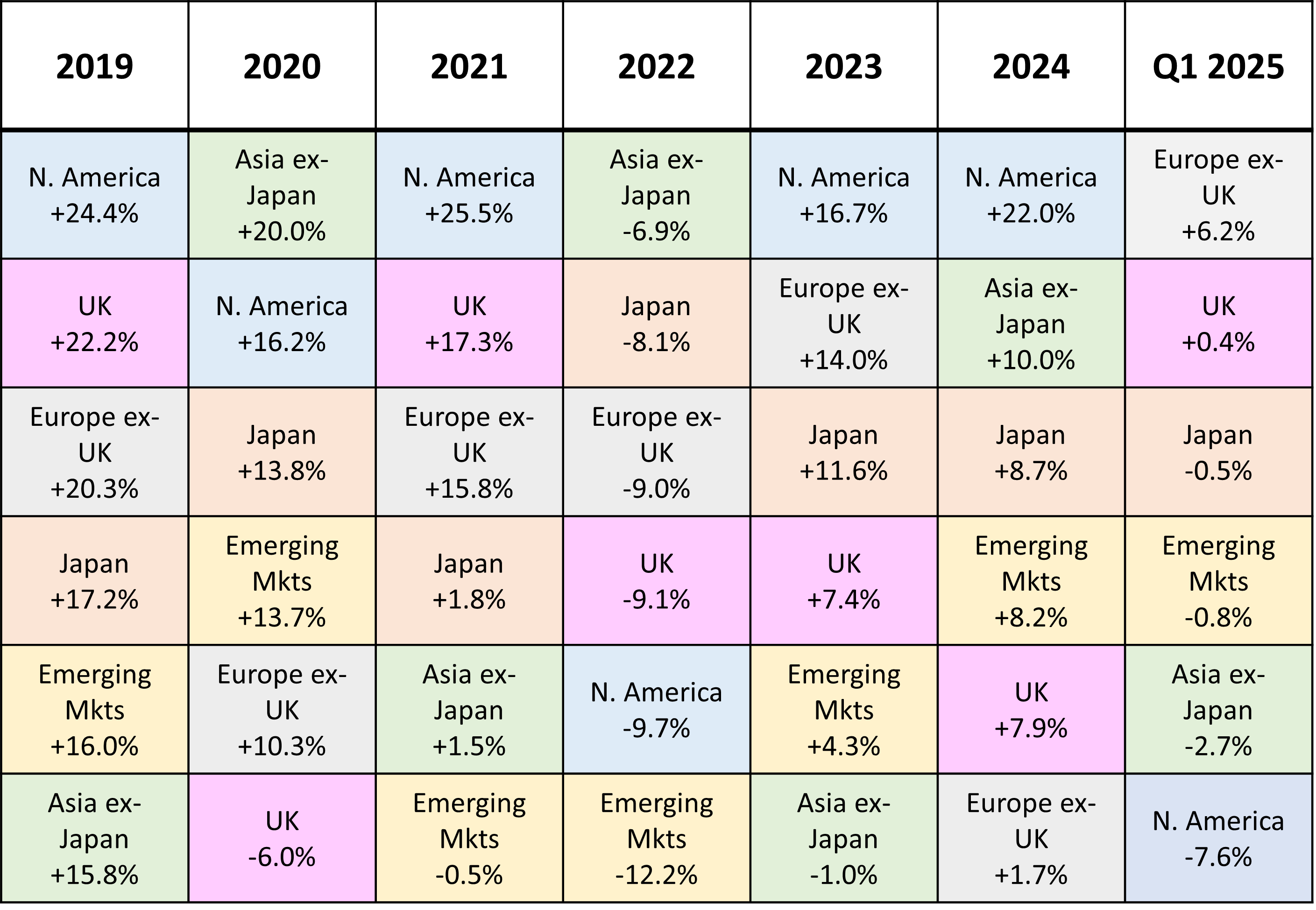

European equities were the standout performer, returning 6.2%, buoyed by defence spend commitments and additional easing of monetary policy. Unsurprisingly, returns from defence stocks were particularly spectacular; German arms manufacturer Rheinmetall posted a quarterly gain of 114%. Broadly speaking, value outperformed growth, with cyclical sectors such as financials outperforming. The UK also enjoyed a strong quarter in relative terms (+0.4%); while the government may have found itself in something of a fiscal bind, equity markets were largely unperturbed. Gains were concentrated in large cap stocks, whilst more domestically focussed mid and small caps lagged. Japanese equities were marginally lower (-0.5%) as the strengthening yen proved a headwind for exporters.

Turning to Asia, Chinese equities continued their recovery from last year’s lows, helped by a combination of less-punitive-than-feared US tariffs (so far) and excitement surrounding DeepSeek’s AI breakthrough (which we covered in January’s monthly commentary), which drove returns for Chinese technology companies. In contrast, Indian and Taiwanese stocks were both sharply lower; with Taiwanese tech stocks caught up in the wider US-led sell-off.

Against a volatile backdrop for equity markets, bond investors generally fared better. Despite the precarious fiscal backdrop, UK gilt yields rose just 10 basis points over the quarter, a move more than offset by the bond’s income component. Sterling corporate and high yield bonds also produced positive returns. Further afield, while economists fear incoming tariffs will lead to a tick up in inflation, in the short term at least, rising recession risks dominated market sentiment. Against this backdrop, US Treasuries returned 2.9% in dollar terms, though for sterling investors much of the gain was eroded by currency movements. In contrast, expectations of much larger issuance to fund future defence spend weighed on European government bonds.

Alternatives were mixed but broadly outperformed global equities, with infrastructure and listed property returning 2.5% and -0.8%, respectively. In the commodities space, the standout performer was gold, which returned 14.7%. The price per ounce of the yellow metal passed the symbolic $3,000 threshold in early March, as investors flocked to the traditional safe-haven asset against a backdrop of growing economic uncertainty.

Major market total returns in Sterling. Data correct as of 04/04/25. Sectors used: Asia ex-Japan – IA Asia Pacific ex-Japan TR (GBP), Emerging Mkts – IA Global Emerging Markets TR (GBP), Europe ex-UK – IA Europe excluding UK TR (GBP), Japan – IA Japan TR (GBP), N. America – IA North America TR (GBP), UK – IA UK All Companies TR (GBP).

Asset Allocation & Portfolio Activity

Q1 was a busy quarter for portfolio activity. Note that the following discussion is not an exhaustive list of changes made and due to the individual model mandates, changes discussed may not apply to every Whitechurch portfolio – for full details on activity within a specific strategy, investors should revert to the fact sheet.

Equities

Global emerging market exposure was increased across the higher risk portfolios. With US exceptionalism at risk of fading and the dollar weakening, further global diversification should benefit the portfolios if there is a more prolonged shift in market leadership.

Fixed Income

We made a series of changes to our high level fixed income exposure, including a new government bond sleeve comprising UK gilts (vanilla and index-linked) and some short duration (lower interest rate risk) global index linked bonds. With the additional compensation investors are paid for owning higher risk corporate bonds (known as the spread) currently at near-record lows, government bonds currently offer an attractive form of ‘insurance’ should the global economy begin to show signs of stress. Concerns about the global growth outlook also led us to increase the portfolios overall duration exposure through a reduction in our short-dated corporate bond allocation, in favour of more market neutral positioning.

Alternatives

We sold our remaining direct renewable energy investment trust exposure. We still see opportunities in the sector, however improving fundamentals have been overwhelmed in recent months by market dynamics, with a lack of appetite amongst institutional investors proving a drag on the broader sector. The proceeds were recycled into funds offering exposure to similar underlying assets, but in an open-ended investment vehicle providing a superior liquidity profile.

Quarterly Outlook

The first quarter of 2025 has been something of a rollercoaster ride for investors; with tariff policy subject to change in short order, market volatility looks set to continue in the medium term. Even as tariffs come into effect, there is an expectation that at least some of the more punitive measures will be rolled back in return for concessions from trading partners. What these concessions might look like, and how the tariffs that do stick impact the global balance of trade, is almost impossible to predict. At the highest level, tariffs look set to worsen the near-term growth/inflation dynamic, whilst making products and services more expensive for American consumers. It remains to be seen as to whether the US economy can adjust quickly enough to avoid an economic downturn. Trump may well bid farewell to politics at the end of his second term, but his Republican party will be all too aware of voter’s sensitivity to the economy – if Trump’s new trade policies don’t bear fruit in fairly short order, the President may face increasing scrutiny from his own party, and the electorate.

Against this uncertain backdrop, we believe true diversification remains an investors’ best defence. Years of economic exceptionalism have favoured a large allocation to US equities – we have always favoured a more balanced approach, while acknowledging that it has been a drag on relative performance in recent years. But with tariff policy casting a cloud of uncertainty over the world’s largest economy, we see opportunities in other, ‘unloved’ parts of the market, not least the UK which continues to trade at a sizeable discount to peers.

While inflation is likely to remain elevated in the months ahead, central bank policymakers may be inclined to look through any short-term tariff-driven price pressures, over which they have little control. Recent comments from the Fed suggest central bankers are more focussed on the worsening growth outlook. Against this backdrop, higher quality bonds should once again provide material diversification benefits – if growth does slow sharply, there is the possibility of significant capital gains. In the meantime, investors get paid to wait.

| Whitechurch Securities Ltd Investment Team | April 2025 |

Whitechurch Investment Team

Quarterly Review, Q1 2025

(Issued April 2025)

FP3892.07.04.25

Important Notes: This publication is issued and approved by Whitechurch Securities Limited, a division of Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority (FCA). We have made great efforts to ensure all content is correct and do not accept any responsibility for errors or omissions. All information is intended to be of a general nature, will not be suitable for everyone and should not be treated as a specific recommendation. We recommend taking professional advice before entering into any obligations or transactions. Investment returns cannot be guaranteed, past performance is not a guide to future performance and investors may not get back the full amount invested. Stockmarkets are not a suitable place for short term investments. Levels, bases of, and reliefs from taxation are subject to change and values depend on circumstances of the investor.

Our Environmental, Social, and Governance (ESG) Credentials:

Whitechurch Securities Limited are fully committed to the FCA’s AntiGreenwashing Rules and have a robust process to ensure all our ethical investment strategies are managed to strict mandates. However, as we rely on third party fund managers for the underlying investment decisions, we cannot guarantee that our own ESG criteria are being met 100% of the time, despite our best efforts to do so. Our ESG fund screening, selection, review and ongoing monitoring process is available on our website or upon request.Data Protection: Whitechurch may have received your personal data from a third party. If you invest through us, we may use your information together with other information for administration and to make money laundering checks. We may disclose your information to our service providers and agents for these purposes. We may keep your information for a reasonable period in order to manage your investment portfolios. We record telephone calls, to make sure we follow your instructions correctly and to improve our service to you through training of our staff. You have a right to ask for a copy of the information we hold about you and to correct any inaccuracies. When you give us information about another person you confirm that they have appointed you to act for them; that they consent to the processing of their personal data, including sensitive personal data and to the transfer of their information and to receive on their behalf any data protection notice.

Whitechurch Securities Limited is authorised and regulated by the Financial Conduct Authority. Financial Services Register No. 114318.

Registered in England and Wales 1576951. Registered Address: C/o Saffery Champness, St Catherine’s Court, Berkeley Place, Bristol, BS8 1BQ

Correspondence Address: The Old Chapel, 14 Fairview Drive, Redland, Bristol BS6 6PH Tel: 0117 452 1208 Web: www.whitechurch.co.uk