Quarterly Review - Q2 2025

15th July 2025

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

Macro

The second quarter saw a continuation of the widespread volatility witnessed in Q1. Whilst geopolitical tension around the US’ tariff policy dominated headlines early on, it was exacerbated by escalating conflict in the Middle East. Despite the volatility, any resulting market selloffs were seemingly short-lived, with the quarter being firmly net positive for risk assets. Whilst the punitive tariffs announced on 2nd April’s highly anticipated “Liberation Day” were initially met with disdain, investors welcomed the series of climbdowns in the subsequent days. To this end, global equities outperformed their fixed income counterparts by 5.1%, with all major regions registering healthy returns. In my April market commentary, I wrote how investors were not only trying to gauge the potential impact of said tariffs but also trying to identify potential winners and losers. Given that they were both more far-reaching and severe than perhaps first anticipated, their potential impact will likely be debated even more ex-post. The almost immediate trade war that ensued only appeared to add to the lack of clarity.

Whilst bonds reacted better in the immediate aftermath, this was very temporary. Investors seeking shelter from volatility will have benefitted from an initial shift lower in yields, but by 11th April the yield on the 10-year Treasury had risen ~50 basis points to 4.49%, sending bond prices lower (prices move inversely to yields). The unusual dynamic of dramatically rising rates amid a sharp equity selloff piled pressure on the US government to do something to diffuse the situation. Seen by some as a capitulation, and others as a necessity, a 90-day pause on all tariffs (except for those levied on China) was announced. Despite a then arguably slightly less aggressive rhetoric from the US, it was still met by a raft of retaliatory measures from some of their biggest trading partners. Whilst much has been written regarding the widescale inflationary impact, this has yet to come to fruition, with all major developed regions broadly in line with expectations during the period. Albeit not purely tariff-related, the fear is that any sizeable tick up in inflation would support higher for (even) longer interest rates, likely setting growth expectations lower.

As trade tensions eased, mounting conflict in the Middle East ensured the geopolitically volatile backdrop was maintained throughout the quarter. That said, even when coupled with decidedly mixed economic data, consumer confidence has not been fully deterred, particularly in the US, where it rose for the first time in six months in June. Labour markets remained broadly resilient too, despite signs of slowing wage growth in the UK. Global manufacturing and services output, as measured by global composite PMI, retracted to a 17-month low in April before edging higher ahead of quarter end. Debt also remains a worry, both at government and consumer level, with the latest debt-to-GDP numbers showing the former as significantly higher for Japan and US versus the UK and Europe. At a household level, delinquency rates on credit card loans in the US have reached levels in the last 12 months not seen since 2012. Testament to the inconsistent and unpredictable landscape were the ever-changing economic growth forecasts and broad set of capital market assumptions published during the quarter.

Markets

Rather unsurprisingly, global volatility hit a post-pandemic high in early April, but as alluded to already, it did not take long for investors to shake off tariff-related concerns. In fact, despite initially declining as much as 12% in some cases, all major regional equities were back in positive territory by mid-May. The arguably muted net response was, at least in part, down to the fact that markets had already moved in Q1 to price in tariffs, albeit at a lower rate. A strong corporate earnings season, particularly for US technology names was key to the equity recovery. This was headlined by AI hardware giant, Nvidia, who reported quarterly revenue of $44.1 billion in May – an increase from $26 billion in the same period last year. This contributed significantly to a strong period for growth stocks, with several major US markets back to all-time highs by quarter-end. However, as we have written before, investors have seemingly been somewhat spooked by the narrowness of markets, and indeed by concerns over US exceptionalism more generally. Whilst valuations remain high, sentiment towards other regions continued to improve.

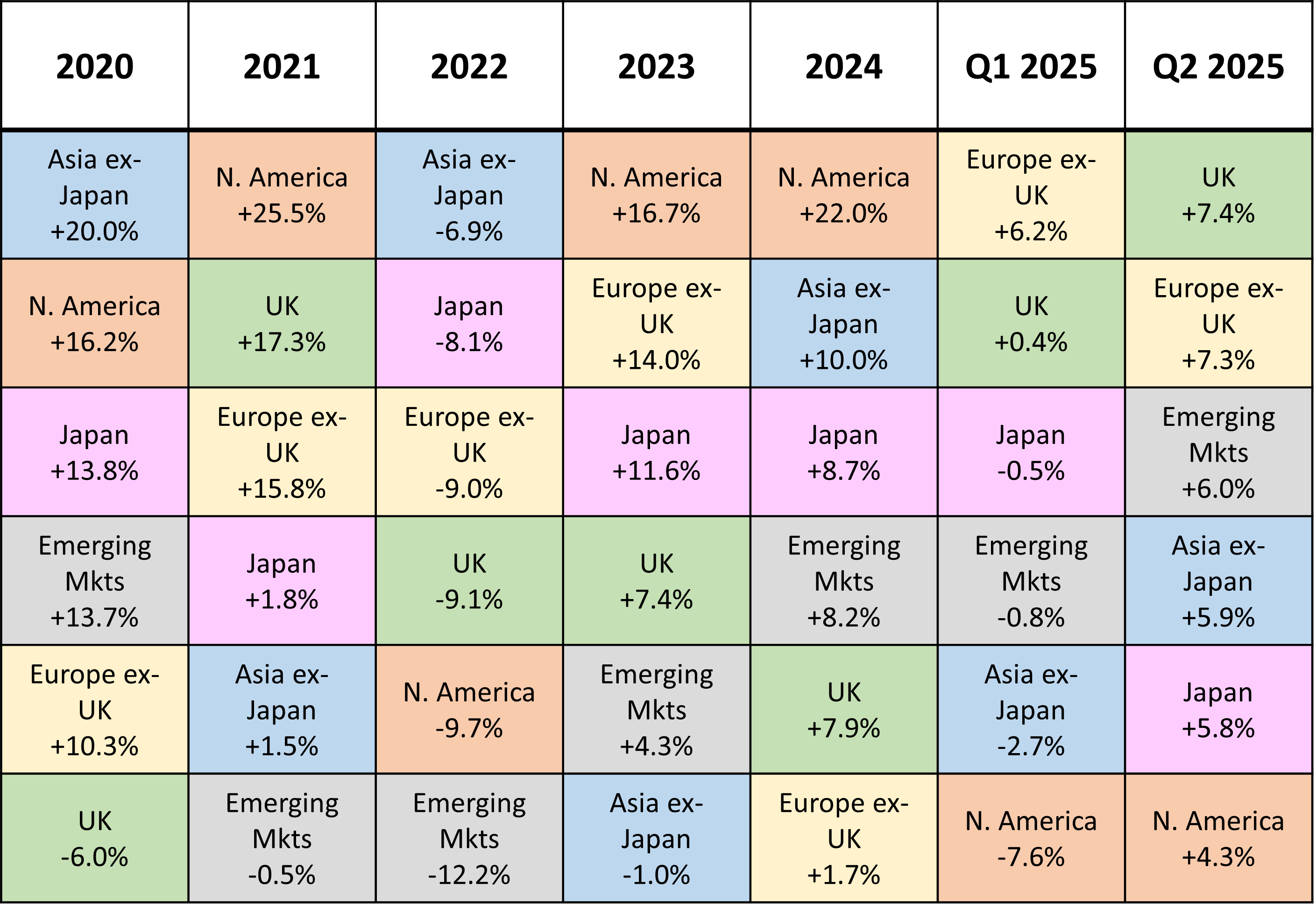

As for quarterly returns, the UK (+7.4%) was the best performing region, closely followed by Europe (+7.3%) – the latter significantly ahead of any other major region year-to-date. Both were net beneficiaries of a general broader reallocation of assets away from the US, as well as the performance of the defence sector – with governments in both regions pledging to increase spend. Also supporting the case for European equities was a further interest rate cut from the European Central Bank to its lowest point in two years. Supporting this was the trajectory of headline inflation, which reached an eight-month low (1.9%) in May before finishing the quarter at the official target rate of 2%. Japan also posted solid (+5.8%) gains as it too benefitted from a strong corporate earnings season, as well as corporate governance reforms favouring shareholder dividends and buyback programmes. Emerging markets outperformed aggregate developed market returns, despite a negative contribution from Chinese equities. These were offset by gains elsewhere, particularly those from Korea and Latin America. US dollar weakness was another contributory factor.

Sanguine quarterly returns of 0.5% for bond markets only tell part of the story in what proved to be a relatively eventful period. There was an increasing divergence between the returns of government and corporate bonds, with the latter initially underperforming before finishing the quarter marginally ahead. The returns of investment grade and high yield also widened to ~3% in April before narrowing somewhat in May and June. As with equities, some of the best returns came from Europe, despite May’s record issuance of euro investment grade bonds increasing supply. This was fuelled in part by the so-called reverse Yankee issuance i.e., US firms issuing their euro-denominated bonds into the European market. One of the main talking points, however, was the US House of Representatives’ passing of the “One Big Beautiful Bill”. The ~900-page act is essentially aimed at reducing taxes and medical costs for US citizens, as well as increasing energy and defence spend. The approval raised further questions over the sustainability of US debt – the scale and persistence of the deficit contributing to a steepening of the yield curve.

Another theme carried through from previous quarters was the depreciation of the US dollar, which suffered a -7.1% decline. Despite still making up ~57% of global currency reserves – the highest of any currency by some margin – this still represents the lowest level in 25 years. As a reference point, this was ~72% in 2000. Gold – another perceived safe-haven asset – suffered a marginal decline but has still returned ~30% over the last 12 months. Conversely, the returns for industrial metals – which have been plagued by trade tensions and a potential slowdown in economic growth – underperformed their precious metal counterparts with a return of -3.7%. These fears also impacted the price of oil, which added to the already precarious predicament following an escalation of Middle Eastern conflict and an announcement to increase production from oil cartel, OPEC. This led to a -12.7% decline in the oil price, finishing the quarter at the ~$67 per barrel level. Other alternative asset classes, such as listed real estate and infrastructure continued their recovery, posting strong gains of +2.3% and +3.5% respectively. As for the latter, this equates to a +5.8% outperformance of global equities over 12 months.

Major market total returns in Sterling. Data correct as of 30/06/25. Sectors used: Asia ex-Japan – IA Asia Pacific ex-Japan TR (GBP), Emerging Mkts – IA Global Emerging Markets TR (GBP), Europe ex-UK – IA Europe excluding UK TR (GBP), Japan – IA Japan TR (GBP), N. America – IA North America TR (GBP), UK – IA UK All Companies TR (GBP).

Asset Allocation & Portfolio Activity

We wrote extensively last quarter how we realigned the Whitechurch portfolios with our updated strategic asset allocation framework, thus there were no notable changes in Q2.

Quarterly Outlook

Given all that has been thrown at markets in recent times, the resilience has been somewhat remarkable. At time of writing, several major indices are, once again, trading at all-time highs. Despite the backdrop of lingering inflation and heightened geopolitical tension, investors clearly see enough reasons for optimism. Whilst on occasion this appears to be very much a case of markets reacting favourably to worst case scenarios being avoided, there are still some positive shoots across the asset class spectrum. We have long talked about robust corporate earnings and labour markets as catalysts, particularly in the US, even if they are also fuelling the higher for longer (interest rates) narrative. Whilst the last eight-months in particular have proven to be a rollercoaster ride for investors, the consensus that the Trump administration is pro-business – or at the very least, pro-America – remains intact. Such is the dominance of US markets – some ~72% of listed developed equities, that a healthy American economy is almost certainly positive for risk assets generally.

Something investors are increasingly facing however is extreme uncertainty – not just in light of the current US government but also given the way that geopolitics has evolved in recent years. News flow has never been quicker, nor has there ever been such a threat from misinformation. One of the most recent contests – the race to achieve domination in AI – is clearly still being won by the US, despite Q1s spotlight on Chinese disruptor, DeepSeek. This will likely continue to evolve and given the sheer potential this could have on businesses around the world, will likely dictate the state of play in equity markets for the foreseeable. This, at least for now, seems to have been prioritised over any previous quest to conquer the renewable energy market. Q2 marked five-years since the outbreak of the pandemic shook global stock markets. Remarkably, this is now looking increasingly like a rather negligible blip on otherwise fairly consistent long-term equity performance charts.

One of the lingering themes from the period however is reshoring – the notion that the production of goods returns to a company’s country of origin. Whilst question marks remain about the feasibility of this on a grand scale, the US narrative during April’s trade war confirmed that this remains a focus. As for the coming period, Trump’s 90-day pause is due to end in early July, which will leave investors pondering whether it will be extended, or indeed whether a whole new set of rules will be set. US markets might have recovered any ground lost earlier in the year already, proving that those who ‘bought the dip’ prospered, however investors will be conscious that authorities have become increasingly data dependent. Any meaningful cracks in a thus far resilient labour market or corporate landscape could potentially derail things. The case for diversifying away from the US has been strengthened recently, and valuations – in the UK and Europe for example – still appear comparatively attractive. Although investors will be mindful of above target inflation and mounting government debt in the former.

Trade dynamics will continue to be key for Asian equities too. Despite the argument for a new multipolar allocation, emerging markets typically form a far smaller part of our portfolios than their developed market counterparts. Investors will also be mindful that any reversal in the trajectory of the US dollar could hamper performance too. As for other asset classes, bond markets have seen government yields rise on fiscal concerns. Higher quality and shorter-dated bonds have prevailed more recently and for now, it would appear to pay to continue to be positioned in the belly of the yield curve – namely, where still tethered to short-term interest rate expectations. Central banks will no doubt remain in the spotlight in H2, with heightened uncertainly likely forcing a cautious approach for now. That said, interest rates in most major economies are still trending lower, benefiting alternative asset classes such as infrastructure. As well as the relatively low correlation to the traditional ‘60/40’ portfolio, we have been pleased to see that several of our funds in this space have offered a notably lower volatility profile than equities year-to-date.

| Whitechurch Securities Ltd Investment Team | July 2025 |

Whitechurch Investment Team

Quarterly Review, Q2 2025

(Issued July 2025)

FP3928.15.07.25

Important Notes: This publication is issued and approved by Whitechurch Securities Limited, a division of Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority (FCA). We have made great efforts to ensure all content is correct and do not accept any responsibility for errors or omissions. All information is intended to be of a general nature, will not be suitable for everyone and should not be treated as a specific recommendation. We recommend taking professional advice before entering into any obligations or transactions. Investment returns cannot be guaranteed, past performance is not a guide to future performance and investors may not get back the full amount invested. Stockmarkets are not a suitable place for short term investments. Levels, bases of, and reliefs from taxation are subject to change and values depend on circumstances of the investor.

Our Environmental, Social, and Governance (ESG) Credentials:

Whitechurch Securities Limited are fully committed to the FCA’s AntiGreenwashing Rules and have a robust process to ensure all our ethical investment strategies are managed to strict mandates. However, as we rely on third party fund managers for the underlying investment decisions, we cannot guarantee that our own ESG criteria are being met 100% of the time, despite our best efforts to do so. Our ESG fund screening, selection, review and ongoing monitoring process is available on our website or upon request.Data Protection: Whitechurch may have received your personal data from a third party. If you invest through us, we may use your information together with other information for administration and to make money laundering checks. We may disclose your information to our service providers and agents for these purposes. We may keep your information for a reasonable period in order to manage your investment portfolios. We record telephone calls, to make sure we follow your instructions correctly and to improve our service to you through training of our staff. You have a right to ask for a copy of the information we hold about you and to correct any inaccuracies. When you give us information about another person you confirm that they have appointed you to act for them; that they consent to the processing of their personal data, including sensitive personal data and to the transfer of their information and to receive on their behalf any data protection notice.

Whitechurch Securities Limited is authorised and regulated by the Financial Conduct Authority. Financial Services Register No. 114318.

Registered in England and Wales 1576951. Registered Address: C/o Saffery Champness, St Catherine’s Court, Berkeley Place, Bristol, BS8 1BQ

Correspondence Address: The Old Chapel, 14 Fairview Drive, Redland, Bristol BS6 6PH Tel: 0117 452 1208 Web: www.whitechurch.co.uk