Quarterly Review - April 2024

8th April 2024

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

Capital Gains Tax Changes: You may be aware that in the March 23 Spring Budget the Government announced changes to the Capital Gains Tax (CGT) allowances available. From the 6th April 2024 the CGT annual exempt amount (amount of capital gains tax you can incur before having to pay tax) for individuals will decrease to £3,000. If you have investments held outside an ISA or Pension account, or if you have subscribed to ‘auto-ISA’ to complete your ISA subscription from your general investment account you may be affected by this reduction in Capital Gains Tax allowance. If you are unsure of your position or you need information or advice on this matter please speak to your adviser.

Macro & Markets

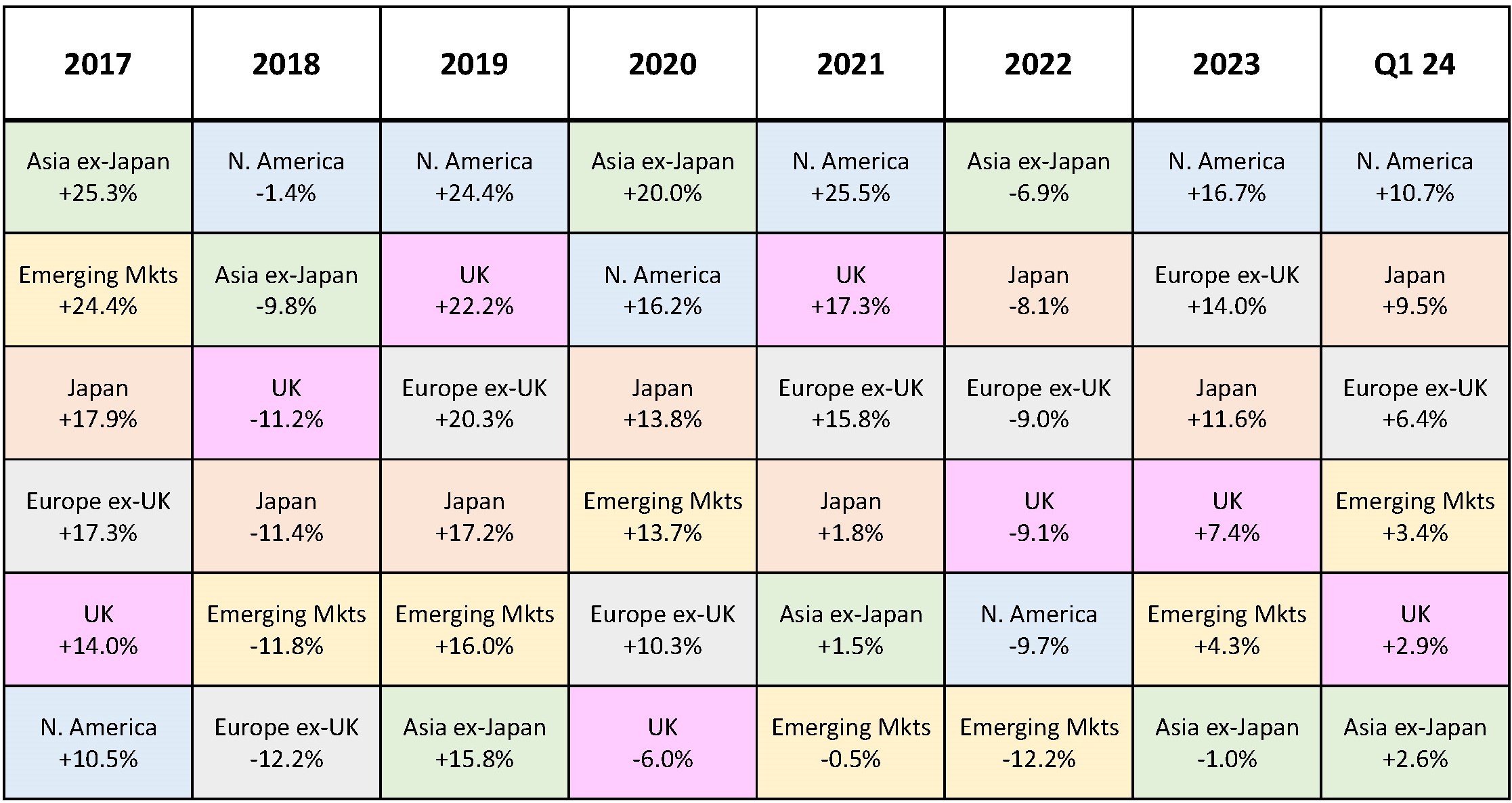

Source: FE Analytics. Major market total returns in Sterling. Data correct as of 02/04/24. Sectors used: Asia ex-Japan – IA Asia Pacific excluding Japan TR (GBP), Emerging Mkts – IA Global Emerging Markets TR (GBP), Europe ex-UK – IA Europe excluding UK TR (GBP), Japan – IA Japan TR (GBP), N. America – IA North America TR (GBP), UK – IA UK All Companies TR (GBP).

Macro

Unlike the ‘everything rally’ that closed out 2023, Q1 2024 saw the performance of major asset classes diverge, after two years during which true diversification has been difficult to find. For equity investors there was much to cheer - led once again by some of the world’s largest companies, developed market stocks approached all-time highs. There was less positive news for bond investors, as forecasts for rate cuts were pared back following ongoing economic resilience in the US, and signs that while inflation is now within touching distance of central bankers’ 2% targets, the last mile could prove the hardest.

January began in risk-off mode, as markets took a breather and reassessed the outlook for the year ahead. Speculation that the US Federal Reserve (the Fed) could begin cutting rates as soon as March was quickly downplayed, as economic data continued to point to an economy in good health – data released in January showed US Gross Domestic Product (GDP) growing 3.3% in Q4 2023, smashing analysts’ 2% forecast. At the same time, there were signs that it may be too early for the Fed to declare victory in its war against inflation – December’s data showed prices rising 3.4% year-on-year, ahead of consensus forecasts and the first monthly increase since the previous summer. Elsewhere, economic data was more mixed. In the UK, a two-year high in consumer confidence was offset by weaker than expected retail sales, while alike to the US, inflation surprised on the upside. On the other side of the English Channel there was more positive news, as European manufacturing and services output ticked up (albeit remaining in contractionary territory). Germany remained a notable exception – its energy intensive economy continued to deteriorate, with 37% of German manufacturers reporting a lack of new orders (versus 21% a year earlier).

February saw the onset of earnings season in the US, with some of the largest companies in the world reporting. All eyes were on Nvidia, the poster child for Artificial Intelligence (AI), whose share price has skyrocketed as demand for its Graphical Processing Units (GPUs) from AI providers soars. When the results were announced, it once again beat analyst’ expectations, leading to the largest one-day positive move (in total market cap gain) for a single company in stock market history. Despite a second consecutive upside inflation surprise, the broadly positive earnings season saw US equities rally. Elsewhere, the UK slipped into technical recession (defined as two consecutive quarters of negative GDP growth), while Japan narrowly avoided one (Q4 GDP was revised up, from -0.4% to +0.4%).

Q1 ended on a positive note for markets, with major equity and bond indices posting solid gains in March. Of note was the Bank of Japan’s (BoJ) decision to end its zero-interest rate policy, its first-rate hike since 2007. While rising rates have proved a major headwind in other developed markets, the modest nature of the hike (0%-0.1% from -0.1%-0%) was viewed positively, a sign perhaps that the Japanese economy is moving into a period of more ‘normal’ fiscal policy. However, the policy shift did little to support the yen, which slipped to its lowest level versus the dollar since 1990. There was positive news elsewhere, too, with US Q4 GDP revised upwards to 3.4%, as well as tentative signs of life in the struggling Chinese economy. Industrial production in the latter rose 7% in February, with retail sales also rising 5.5%, prompting an end-of-quarter rally for Chinese equities.

Markets

Moving on to markets where despite January’s volatility, all major regions produced strong positive returns (in sterling). US equities were once again the standout performer, brushing off a series of above-consensus inflation reports to finish the quarter with double-digit gains (+10.7%). Large cap technology stocks were among the best performers (of note were Nvidia +84.1% and Meta +38.4%), however growing optimism over the health of the US economy meant more economically sensitive areas of the market also performed well.

Hot on the heels of the US market was Japan (+9.5%). Large cap stocks once again outperformed as corporate reform continued to attract foreign inflows, while the end of the negative interest rate era did little to deter investors. Further weakening of the yen was an additional tailwind for overseas investors. Europe ex-UK also posted solid gains (+6.4%), driven by an uptick in activity data which could suggest that for the struggling Eurozone economy, the worst has passed. Mirroring 2023, the UK lagged its developed market peers, though it was the strongest performer through March, helped by the Bank of England Governor stating that interest rate cuts were ‘on the way’ with three anticipated rate cuts later this year.

Despite trailing other regions, aggregate emerging markets also produced a positive return (+3.4%). While Chinese equities disappointed in absolute terms (-1.3%), they rallied through February/March as economic data appeared to improve. When compared to the historical average, Chinese equity valuations look exceptionally cheap, but with the struggling real estate sector continuing to weigh on sentiment, further stimulus from the Chinese authorities may be required to entice foreign investors. Elsewhere in emerging markets, Taiwan (+13.5%) and India (+7.0%) both produced strong returns, while Brazil underperformed (-6.5%).

It was a disappointing start to 2024 for fixed income markets, as stickier inflation and resilient economic data hinted at a delay to the rate cutting cycle across developed markets. Global aggregate bonds returned -1.2%. In the US, markets ended 2023 with forecasts for six rate cuts through 2024, with the first cut as early as March. However, with inflation running hotter than expected and the Fed seemingly retreating from its dovish (favouring lower rates) December stance, expectations were pared back. At the close of Q1, markets were pricing three rate cuts for 2024, broadly in line with the Fed’s own expectations. With the potential for imminent rate cuts diminished, areas of the market with lower interest rate sensitivity, including short-dated credit and high yield, outperformed. In the UK, gilts once again underperformed (-1.6%), with elevated service inflation and strong wage growth cited as reasons for a potential delay in cutting rates.

Other rate sensitive asset classes also suffered as rate cut optimism faded. Aggregate global real estate investment trusts (REITs) declined -0.6%, while infrastructure (-1.7%) and direct (bricks and mortar) property (-0.7%) also slipped into the red. Notably, in the infrastructure sector, battery storage assets underperformed, with the three specialist listed investment trusts falling 45% on average – the sector has seen a sharp fall in revenue generation, driven by lower power prices and low utilisation by the national grid operator.

Asset Allocation & Portfolio Activity

Following a busy end to 2023, portfolio activity was limited, though we made a small number of fund specific changes.

Note that the following discussion is not an exhaustive list of changes made and due to the individual model mandates, changes discussed may not apply to every Whitechurch portfolio – for full details on activity within a specific strategy, investors should revert to the fact sheet.

Equities

Despite another strong quarter for developed market equities, we remain cautious, particularly in the US where valuations in some sectors look stretched, and market cap weighted indices carry a high degree of concentration risk. While passives remain a core part of our US allocation, we chose to increase our active US weighting, increasing exposure to less richly valued segments of the market, including small cap stocks, which continue to trade at a near-record discount to large cap peers. In the UK, we reduced our equity income exposure – the sector has been a useful source of yield for the income focussed portfolios, but with bonds now providing an attractive income, there is greater flexibility to seek capital growth. We mirrored the US move, using the proceeds to increase our small and mid-cap weighting, anticipating that the move towards rate cuts should help close the discount that persists versus large cap peers.

In Europe, we sold out of our income-focussed mandate in favour of a fund with more of a blended investment style. With lower inflation and a weaker economy than other developed markets, we think the European Central Bank could be the first among its peers to cut rates, a move which could be favourable for more growth-orientated areas of the market.

We made no changes to our emerging markets allocation, maintaining a preference for broad geographical diversification. Chinese equities look exceptionally cheap relative to historical averages, but we still see few catalysts for a sustained recovery, while there is a non-negligible risk of the whole region becoming a ‘value trap’. On the flip side, Indian stocks look expensive, but demographics and the macroeconomic backdrop are, in our view, more supportive of future growth. We maintained our preference for owning both regions simultaneously, with the differentiated return profiles providing significant diversification benefit for the higher risk portfolios.

Fixed Income

We maintained our fixed income overweight through Q1. Despite the pullback across bond markets, we see the asset class as a useful insurance policy, should the impact of higher rates start to be felt in earnest. Several of our managers increased the duration (interest rate risk) of their underlying portfolios over the quarter. However, at portfolio level we retained our neutral/underweight duration positioning, favouring short-dated corporate bonds that continue to provide an attractive yield, but with much lower sensitivity to changes in rate expectations.

Alternatives & Property

No change to allocation – we continue to favour the absolute return sector as a source of uncorrelated returns with lower volatility than the other major asset classes.

Quarterly Outlook

Our view has not changed materially from last quarter – we still feel there are risks to inflation on the upside. In our view, the lacklustre performance of bonds through Q1 means they are now fairly priced given the macroeconomic backdrop, but subsectors with lower interest rate sensitivity still look attractive given the uncertain outlook for inflation. In contrast, global equities extended gains through Q1 – in the US in particular, large cap valuations look stretched, leaving little room for manoeuvre should inflation prove stickier than expected.

The good news for investors is that valuations elsewhere look decidedly more attractive, particularly in Europe and the UK. With inflation in the Eurozone within touching distance of 2%, and the impact of the energy price cap fall likely to produce a similar result here in the UK in the coming months, the European Central Bank and Bank of England should find themselves with more room to cut rates. Whether they cut ahead of the Fed remains to be seen, but in the meantime, the relative ‘cheapness’ of European and UK equities should provide some downside protection as inflation continues its bumpy downwards trajectory.

| Whitechurch Securities Ltd Investment Team | April 2024 |

Whitechurch Investment Team

Quarterly Review, Q4 2023

(Issued January 2023)

FP3715.08.04.24

Important notes: This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest, especially if any reference is made to specific stocks or funds. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. The contents may not be suitable for everyone. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor. Source for performance figures: Financial Express Analytics. Performance figures are calculated from 01/01/2024 to 31/03/2024

Data Protection: Whitechurch may have received your personal data from a third party. If you invest through us, we may use your information together with other information for administration and to make money laundering checks. We may disclose your information to our service providers and agents for these purposes. We may keep your information for a reasonable period in order to manage your investment portfolios. We record telephone calls, to make sure we follow your instructions correctly and to improve our service to you through training of our staff. You have a right to ask for a copy of the information we hold about you and to correct any inaccuracies. When you give us information about another person you confirm that they have appointed you to act for them; that they consent to the processing of their personal data, including sensitive personal data and to the transfer of their information and to receive on their behalf any data protection notice.

Whitechurch Securities Limited is authorised and regulated by the Financial Conduct Authority. Financial Services Register No. 114318.

Registered in England and Wales 1576951. Registered Address: C/o Saffery Champness, St Catherine’s Court, Berkeley Place, Bristol, BS8 1BQ

Correspondence Address: The Old Chapel, 14 Fairview Drive, Redland, Bristol BS6 6PH Tel: 0117 452 1208 Web: www.whitechurch.co.uk