Whitechurch Investment Update: Quarterly Review - Q4 2021

17th January 2022

Click here to download a PDF Version of the Quarterly Review

Welcome to the Whitechurch quarterly investment review. This review covers the key factors that have influenced investment markets over the past quarter and the Whitechurch Investment Team’s current views and broad strategies being employed.

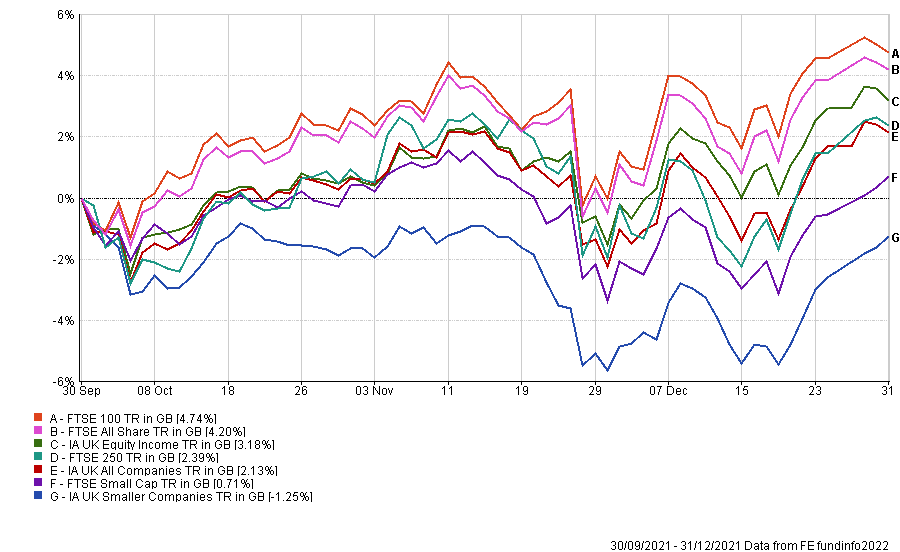

UK Equities

The UK market delivered a return of 4.2%. This reflected a recovery in share prices, during December, following the market sell off at the end of November when concerns over the new Omicron variant were at their peak. Large cap stocks outperformed, with a return of 4.7%, while mid and small cap stocks underperformed with returns of 2.4% and 0.7% respectively. The latter tend to be more domestically oriented than large companies and hence were more likely to be negatively impacted by the Plan B restrictions that were introduced by the government. By sector, the biggest gainers included Utilities (+15.7%) and Real Estate (+11.2%). The strong performance of Utilities partly reflected the exit of several weaker players from the energy market with the expectation that the remaining companies would benefit from less competition. The main sector laggards included Energy (-1.5%) and Consumer Discretionary (+0.1%). The latter includes the retail, travel and leisure industries which were particularly vulnerable to the Plan B restrictions.

Investor sentiment at the start of the quarter was relatively positive. This was despite the well documented supply side issues, such as the shortage of lorry drivers and higher energy prices, which meant that the UK’s economic recovery while rapid was also, in the words of the Institute for Fiscal Studies, “incomplete and wildly imbalanced”. Nevertheless, economic data released during the quarter pointed to a continuation in the economy recovery. The IHS Market Composite PMI rose to a three-month high of 56.8 in October although consumer surveys showed a small reduction in confidence while GDP growth in Q3 was revised downwards from the initial estimate of 1.3% to 1.1%. Inflation remained the central economic issue as in other countries. Data released during the period illustrated the problem: CPI rose from 3.1% in September to reach 4.2% in October, and then 5.1% in November. This compared to the Bank of England’s CPI target of 2.0%. In December, after much procrastination, the Monetary Policy Committee (MPC) finally decided to respond by raising interest rates from 0.10% to 0.25%, the first increase in more than three years.

This tightening in monetary policy came despite the rapid spread of the Omicron variant and the introduction of new economic restrictions under the government’s Plan B. There was also a renewed focus on the vaccination programme with booster doses being offered to all adults following the release of scientific evidence which pointed to the high level of protection afforded by three vaccine injections. As December continued, evidence mounted that the Omicron variant was less virulent than previous variants and this reinforced hopes that further economic restrictions might be avoided. Therefore, sentiment towards UK equities ended the quarter on a positive note. Despite some concerns over inflation, in any case a problem that is hardly unique to the UK, many investors remain attracted to the UK market’s well publicised low valuation.

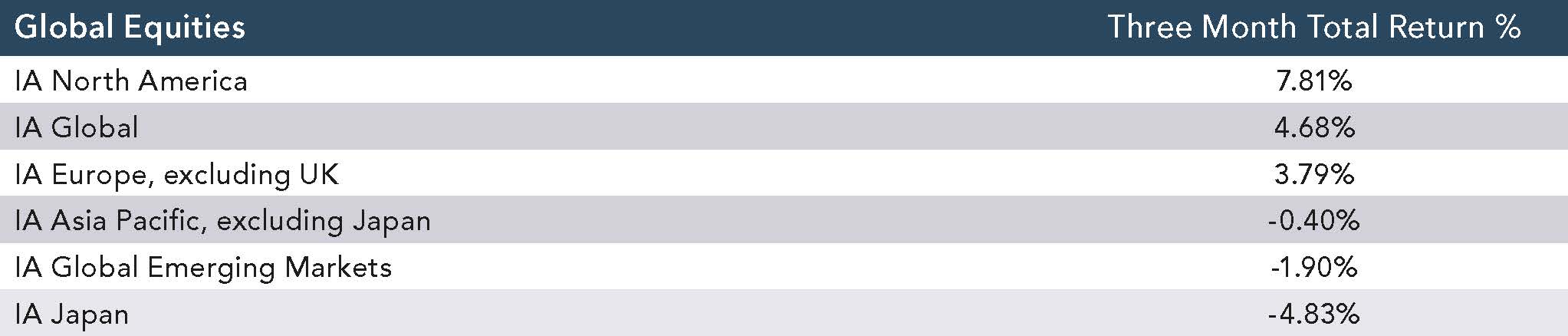

Global Equities

There was a sharp dichotomy in performance terms within global equities. Many developed markets performed strongly while emerging markets were considerably weaker. In the US and Europe, the chronology was similar to the UK - after a positive start to the quarter, concerns over Omicron led to a retrenchment in share prices in late November before positive news on the virulence of the new strain led to a share price rally in December. Economic forecasters remained relatively sanguine through this period. The OECD trimmed their expectation for global economic growth in 2021, from 5.7% to 5.6%, but they maintained their forecast for growth of 4.5% in 2022. However, the economic outlook in Asia is clouded by concerns over the potential impact from the slowdown in China’s indebted property sector. In addition, emerging markets continue to lag developed economies in terms of their vaccination programmes. Scientific research also suggests that the two main Chinese vaccines, Sinopharm and Sinovac, offer almost no protection from Omicron unlike Western vaccines. Sinopharm and Sinovac are not only the main vaccines used in China but are widely used in countries such as Mexico and Brazil. Currency was also a factor impacting performance this quarter, with sterling appreciating against most currencies (but not the dollar) thus reducing returns to UK-based investors.

The US market delivered a robust performance helped by another strong reporting season for companies. By sector, the biggest beneficiaries included Real Estate (+17.0%) and Information Technology (+16.2%). On account of its size, the latter was the dominant influence on the overall market return. The weakest performing sectors included Communication Services (-0.5%) and Financials (+4.1%). The economic recovery showed some signs of slowing with the release of weaker than anticipated annualised GDP growth of 2.3% for Q3. The slowdown reflected ongoing supply chain bottlenecks and growing labour shortages. These factors, as well as the rapid growth in demand for goods, helped fuel inflation. On a CPI basis, US inflation rose to 6.2% in October before climbing to 6.8% in November, the highest level for nearly 40 years. The Federal Reserve responded, in December, by declaring it would accelerate the tapering of bond purchases (first announced in October). In a further shift, members of the Federal Open Market Committee now expect three interest rate increases in 2022, having previously been evenly split over the possibility of one increase, with further increases expected in both 2023 and 2024. Later in December, some economists cut their forecasts for growth given the apparent demise of the $1.75trn social spending bill (better known as ‘Build Back Better’) although the Biden Administration may look at other ways to implement parts of this spending package.

European equities also performed strongly. This was despite a resurgence of covid infections in November, even before the impact from Omicron. This led to the reintroduction of lockdown measures in several countries. In Austria the government announced its intention to make vaccination compulsory. The economic backdrop to this point had been encouraging with the release of figures showing that eurozone GDP had grown by 2.2% in Q3, which was ahead of most other regions. Economic growth has been supported by the loose monetary policy implemented by the European Central Bank (ECB). Indeed, despite eurozone inflation hitting a record high of 4.9% in November, Christine Lagarde, the President of the ECB, indicated that it was “very unlikely” the Bank would increase interest rates in 2022 as the inflation profile was, “like a hump…and a hump eventually declines.” The ECB did announce that it would reduce net purchases under the €1.85trn pandemic emergency purchase programme and halt them altogether in March 2022. However, it cushioned the impact of this move by announcing it would expand its older asset purchase programme (APP).

The Japanese market declined during the quarter although the weakness was exaggerated in sterling terms by exchange rate movements. The economy appears to have stabilised, after recording a greater than expected contraction of 0.8% in Q3, with the au Jibun Bank Composite PMI rising to 52.5 in November from 50.7 in October. Later in the quarter, official figures showed that industrial output rose by 7.2% in November compared with October. This was significantly ahead of forecasts and the largest monthly increase since 2013. Meanwhile investor excitement over the new Japanese Prime Minister, Fumio Kishida, appears to have abated somewhat even though he announced a new ¥43.7trn ($383bn) fiscal package equivalent to about 8% of GDP. The Bank of Japan announced its intention to curtail bond purchases, under its emergency economic support programme, as scheduled, while continuing with the pre-pandemic level of quantitative easing.

Chinese equities performed poorly due to both the ongoing regulatory crackdown on the technology sector and the well-publicised problems in the property sector. Several property developers, most notably Evergrande which defaulted on its debt payments in December, appear close to insolvency. Given that this sector accounts for around 28% of GDP this poses a significant risk to economic growth. The Chinese authorities are aware of the situation and most analysts expect the government will eventually be forced to co-ordinate a restructuring of Evergrande’s $300bn of debt. In the meantime, the People’s Bank of China (PBOC) reduced both the reserve requirement ratio for banks and the loan prime rate, which guides how much interest commercial banks charge to corporate borrowers, in an effort to increase the flow of credit in the economy.

Elsewhere, Russia initially benefited from higher energy prices, early in the quarter, before selling off, partly because of geopolitical concerns following President Putin’s belligerent rhetoric directed at Ukraine and NATO. In Brazil, equities came under pressure from a deteriorating macroeconomic outlook as well as political concerns. Inflation reached 10.3% in the year to October and the central bank reacted by raising interest rates by 150bps, the sixth increase in 2021. Despite these signs of financial strain, the finance minister, Paulo Guedes, once an advocate of fiscal orthodoxy, announced plans for a further $14bn of spending commitments ahead of the 2022 general election. Current polling shows Lula, the left-wing candidate, is well ahead of Bolsonaro, the incumbent President. India was more resilient than most emerging markets with investor sentiment boosted by buoyant economic growth, helped by the strong performance of exports which has kept the current account deficit under control, and a relatively stable political situation compared to other developing countries. This optimistic picture may shift if the central bank, which has hinted as such, begins to moderate its expansionary monetary policy in 2022. Emerging markets are also vulnerable to a stronger dollar which may result from a tightening in US monetary policy. Those, such as Turkey, who borrow heavily in dollars are most susceptible but others, such as Brazil and South Africa, which rely on foreign capital flows may also suffer.

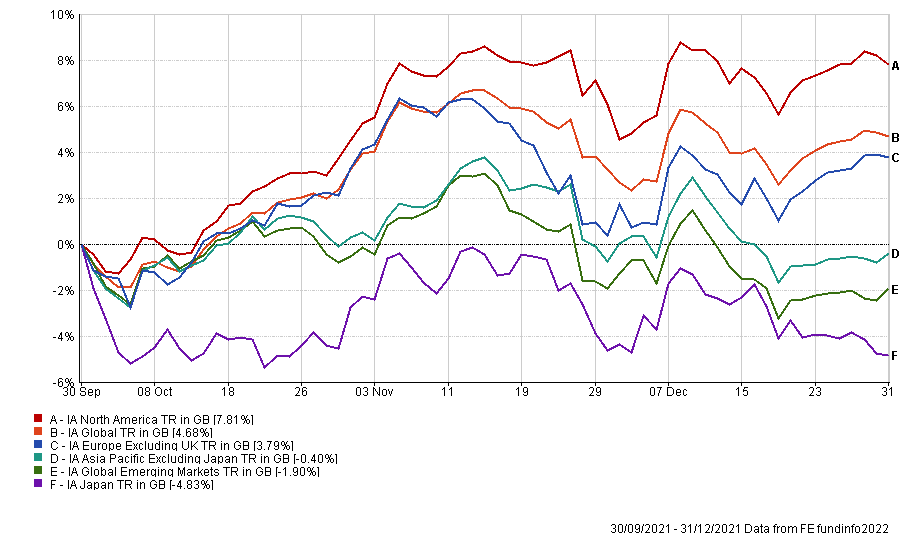

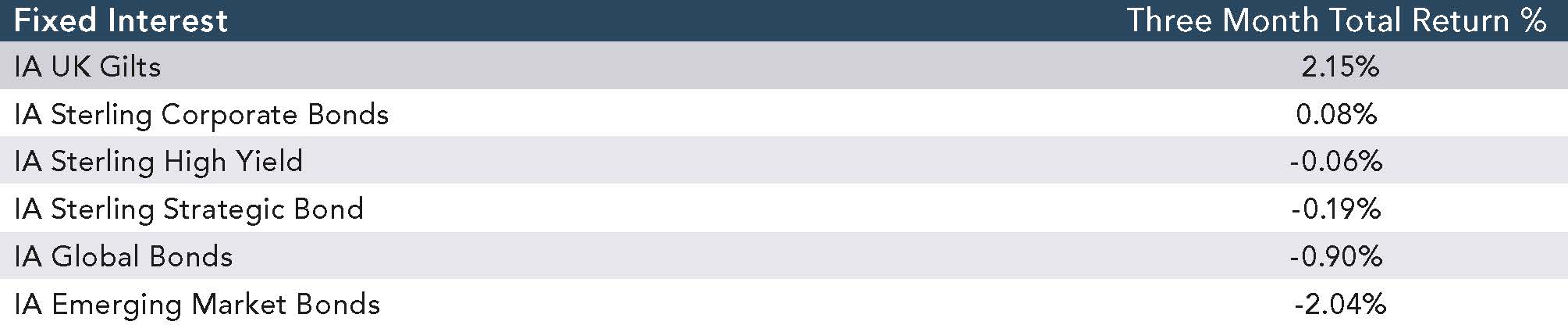

Fixed Interest

In aggregate, government bond markets weakened over the quarter with investor concern over rising inflation, and the implications this has for interest rates, the dominant influence. However, the experience between countries varied. The yield on the benchmark US 10-year government bond edged higher by 3bps to 1.51% while the equivalent UK bond saw a 2bps fall to 0.97%. The UK bond market was among the best performers due to a flattening in the yield curve with price gains at the long end. In most European countries bond yields rose while in Brazil yields fell sharply on concerns over the macroeconomic outlook. Chronologically, government bond markets benefited from a rally in late November when the Omicron variant first emerged. However, once it became apparent that the new strain was less virulent than its predecessors, investors rotated out of safe haven assets and bond prices fell.

As already indicated, the focus for bond investors during the quarter was inflation. Figures released during the period generally revealed higher than expected inflation figures. CPI inflation hit 5.1% in the UK, 4.9% in the eurozone and 6.8% in the US. As might be expected under these circumstances, index-linked bonds significantly outperformed their conventional equivalents during the quarter. Until recently, the larger central banks have characterised inflation as “transitory” and, therefore, concluded that no adjustments to monetary policy were required. However, this changed in Q4, when increasing numbers of central bankers acknowledged the need for monetary policy to be tightened as several smaller central banks had already done. Thus, the Bank of England increased its base rate from 0.10% to 0.25%, the first increase in more than three years, while the Federal Reserve announced it would taper bond purchases and later that it would accelerate that tapering to end purchases in March 2022. The Fed now expects to implement three interest rate rises in 2022. The main exception to this picture remained the ECB which, in its public pronouncements, continued to emphasise that its monetary policy would remain loose and justified this by citing the relatively high level of unemployment (7.3%) in the eurozone.

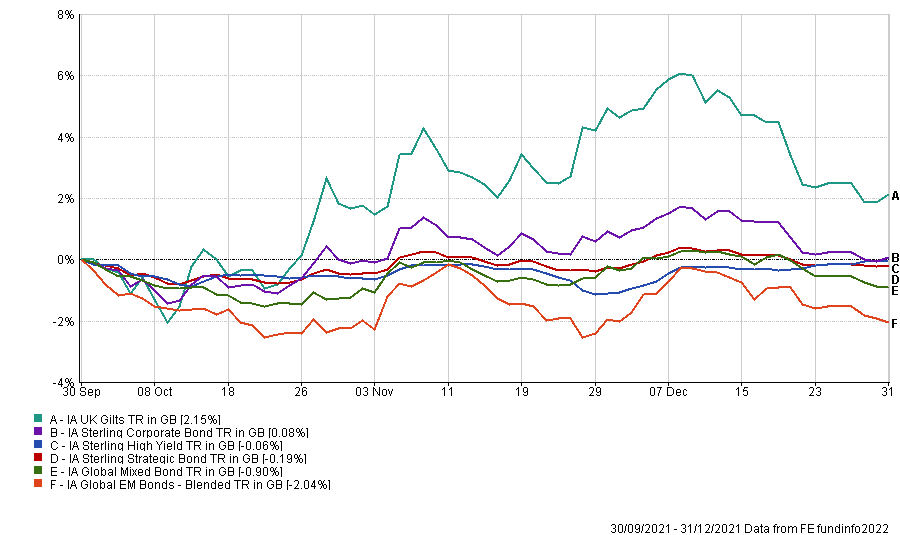

Corporate bonds saw low or negative returns during the quarter, with variations due to country of domicile, sector and credit rating. Chronologically the picture was the opposite of sovereign bonds as corporate bonds sold off in late November, when news of the Omicron variant first broke, on concerns over a weaker economic environment and the negative implication this would have for defaults. However, once it became clear that Omicron was not the disaster that some had initially envisioned, corporate bond prices rallied. Over the quarter as a whole, riskier bond segments such as high yield and emerging markets were the weakest performing areas. In addition to the above factors, emerging market bonds were also negatively impacted by credit downgrades in the Chinese property sector as defaults loomed.

Commercial Property

The UK property sector continued its recovery in Q4. Investor sentiment was initially hit by the announcement of the Plan B restrictions in December. However, the emerging consensus was that Omicron would ultimately prove to be a blip in the long-term recovery of the property market although clearly for certain sectors the new restrictions would have a negative short-term impact. The strength of investor demand for commercial property was evidenced in several ways. For example, Allsop, the property consultancy, recorded a strong quarter for commercial property auctions including 119 lots sold in December alone. Allsop’s view is that “the ability of commercial property to generate income, combined with low savings rates, a market driven by cash rich investors and relatively limited supply, will continue to support prices.”

The strongest segments of the market have been industrials and logistics with low availability underpinning strong rental growth. However, there are also now signs that the recovery is beginning to broaden out with valuations of alternatives, hotels and leisure all rising. In addition, LandSec, the largest UK REIT, recently outlined their view that following a decline over the last five years of c.40% in rents that valuations of prime retail sites may have hit a bottom, with rental yields of 7.5-8.0% available. Crucially LandSec think that retailers can now make money on a store-by-store basis at such sites. The picture for offices remains mixed with long let and prime stock in demand while older secondary stock is generally being shunned by investors.

Commodities

Industrial metals, in general, saw higher prices in the quarter. Having fallen sharply on the back of lower Chinese demand, the iron ore price ended Q4 up 6% at $115/t having traded as low as $80/t in mid-November. Copper, which is seen as a bellwether for the global economy given its wide range of usage across many industries, saw an 8% price rise to $4.40/lb. The energy market experienced volatile trading with a cocktail of different factors playing a role. On the demand side, the emergence of the Omicron variant initially led to concerns that the global economic recovery would be derailed and, as a result, the oil price fell sharply. Once it became apparent that this scenario was unlikely the price recovered. At the same time, on the supply side, OPEC, under pressure from the US, agreed to continuing expanding production by 400k barrels per month. However geopolitical concerns emerged when Russia, itself a major oil producer, massed troops on the border with Ukraine and issued a list of demands to the US and NATO. In the end, both WTI and Brent Crude ended the quarter little changed in price terms from the start of the quarter.

The price of many agricultural commodities rose under the strain of bad weather and supply side problems. Wheat prices increased to their highest level in nine years, on the back of concern over poor harvests in the US and Russia, before easing back somewhat in December. Arabica coffee price futures hit a ten year high on supply side concerns with the arrival of La Niña weather phenomenon and the potential for a drought in South America. Prices later fell from their peak but remain at elevated levels. Within precious metals, gold and silver saw their prices rise by 3% and 6% respectively. In Platinum Group Metals (PGMs), the price of platinum was almost unchanged while the price of palladium gained 2%.

Cash

With many bond yields still relatively low, the opportunity cost of holding cash relative to bonds remained modest. In the short-term, cash deposits insulate investors from the price volatility seen in other asset markets. However, in the long-term, the real value of cash deposits is likely to continue to be eroded by inflation. We currently only hold cash for short-term tactical reasons or within lower risk strategies, where the risk profile dictates a need for a larger cash allocation.

Whitechurch Investment Team

Quarterly Review, Q4 2021

(Issued January 2022)

FP3309.17.01.2022

Click here to download a PDF Version of the Quarterly Review

Important Notes: This publication is approved by Whitechurch Securities Limited which is authorised and regulated by the Financial Conduct Authority. All contents of this publication are correct at the date of printing. We have made great efforts to ensure the accuracy of the information provided and do not accept responsibility for errors or omissions. This publication is intended to provide helpful information of a general nature and is not a specific recommendation to invest. The contents may not be suitable for everyone. We recommend you take professional advice before entering into any obligations or transactions. Past performance is not necessarily a guide to future performance. Investment returns cannot be guaranteed and you may not get back the full amount you invested. The stockmarket should not be considered as a suitable place for short-term investments. Levels and bases of, and reliefs from, taxation are subject to change and values depend on the circumstances of the investor.